- OpenTools' Newsletter

- Posts

- 🎄 The AI Power Grab (Happy holidays!)

🎄 The AI Power Grab (Happy holidays!)

Chips, chatbots and the rules being rewritten this Christmas Eve.

Reading time: 5 minutes

🗞️In this edition

Intel® becomes a strategic AI asset

Italy challenges Meta’s AI gatekeeping

Markets bet on AI spending into 2026

In other AI news –

Yann LeCun launches a post-LLM AI startup

Silicon Valley confronts growing AI skepticism

4 must-try AI tools

Hey there,

While much of the world slows down for Christmas, AI systems do not.

This holiday season marks a quiet but decisive transition. AI is no longer advancing only through better models and bigger datasets. It is colliding with the real world, including physical data, energy grids, regulation, and security, systems that were never designed for this pace of change.

Today’s edition looks at where AI power is shifting, who is starting to push back, and why the next phase of AI will not be decided in research labs alone.

No hype. Just the moves that will matter in the year ahead.

Let’s get into it.

What's happening:

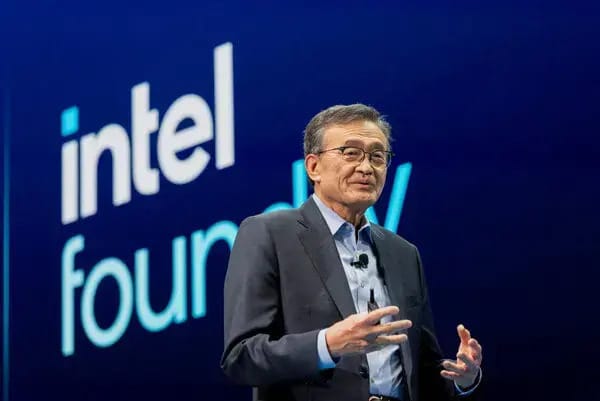

A behind-the-scenes push in Silicon Valley helped stabilize Intel after political pressure put its leadership under scrutiny. According to Reuters, influential dealmakers and industry figures intervened as concerns mounted around Intel’s role in the U.S. semiconductor ecosystem.

The episode underscored how closely Intel’s future is now tied to U.S. strategic priorities — domestic chip manufacturing, AI compute capacity, and the resilience of the supply chain that underpins advanced technologies.

Why this is important:

AI leadership is no longer just a market outcome. It’s becoming a policy objective.

Semiconductors sit at the center of the AI value chain. If chip supply falters, everything downstream slows, from model training to data centers to enterprise deployment. That reality is pushing governments to treat chipmakers less like ordinary companies and more like critical infrastructure.

Intel’s situation highlights a broader shift: AI competitiveness is increasingly shaped by geopolitics, industrial policy, and national security concerns, not just innovation cycles.

Our personal take on it at OpenTools:

Intel’s moment is a reminder that the AI race is built on physical reality.

Models don’t run on ideas alone. They run on fabs, energy, logistics, and political alignment. As AI demand grows, the tolerance for fragility in the hardware layer shrinks fast.

What is striking here is not just that Intel received support, but why. The United States cannot afford to lose depth in chip manufacturing as AI becomes a foundational technology.

As we head into 2026, expect more moments like this: governments quietly stepping in to stabilize the companies that keep AI running.

The AI boom may look digital on the surface. Underneath, it’s deeply industrial.

What's happening:

Italy’s antitrust authority has ordered Meta to suspend contractual terms governing WhatsApp that could prevent rival AI chatbots from operating on the platform. Regulators argue that these terms risk unfairly restricting competition by limiting how third-party AI assistants can access one of the world’s largest messaging ecosystems.

Meta has responded by saying the rules are designed to maintain service quality and avoid confusing users, and the company has indicated it plans to appeal the decision.

Why this is important:

Distribution is becoming the real moat in AI.

If WhatsApp evolves into a primary interface for interacting with AI, control over access to that channel effectively determines which assistants can reach billions of users and which are locked out before they ever compete on merit.

This ruling previews a broader shift expected in 2026: regulators are starting to treat AI not as a standalone feature, but as a market power amplifier that can entrench platform dominance if left unchecked.

Our personal take on it at OpenTools:

Meta is executing one of the oldest playbooks in tech. Publicly, the narrative is about protecting users and preserving quality. Structurally, the effect is tighter control over the interface where the next generation of digital services will live.

If regulators follow through, the impact won’t be immediate or dramatic for Meta’s revenue. The significance lies in precedent. AI assistants may increasingly be treated as competing services that deserve fair access, rather than as apps operating at the discretion of platform owners.

The deeper signal is where competition is shifting. AI battles are moving away from pure model performance and into policy, contracts, and distribution leverage. If you’re building in AI, the legal layer is no longer optional background noise. It’s becoming part of the competitive terrain.

What's happening:

Investors are heading into 2026 anchored around a familiar set of expectations: sustained AI spending, resilient corporate profits, and the prospect of interest rate cuts. AI remains a central driver of market optimism after several years of outsized gains fueled by expectations around AI-led growth.

Even after a long rally, capital markets continue to treat AI not as a passing trend, but as a foundational investment theme shaping medium-term strategy across technology and infrastructure.

Why this is important:

Like it or not, capital sets the tempo.

When markets frame AI spending as a primary engine of economic growth, investment cycles accelerate. More capital flows into data centers, chip production, cloud infrastructure, and enterprise rollouts, reinforcing AI’s momentum across the entire ecosystem.

At the same time, this raises a harder question heading into 2026: where does real return on investment actually show up, and who ultimately captures it?

Our personal take on it at OpenTools:

The most dangerous thing about an “AI narrative” isn’t that it’s wrong. It’s that it can become self-fulfilling.

Capital pours in, everyone builds, and suddenly your strategy isn’t just competing against other products. It’s competing against momentum itself. In that environment, weak execution can be masked for a while, but not indefinitely.

For AI leaders, the practical lens is straightforward. Markets are increasingly rewarding credible execution over promises. The winners in 2026 won’t be the loudest voices or the boldest claims. They’ll be the teams that can consistently explain how the economics work, how deployment actually happens, and which measurable outcomes improve quarter after quarter.

AI is still the story. But 2026 is when that story gets audited.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Meta’s Yann LeCun targets €3bn valuation for AI start-up – The Turing Award winner is raising €500m ahead of launch for a company focused on physical-world intelligence, signaling that top AI talent is doubling down on post-LLM architectures.

Silicon Valley’s tone-deaf take on the AI backlash will matter in 2026 – Elsewhere in AI, Silicon Valley’s enthusiasm is colliding with public unease, as skepticism grows over who really benefits from the AI boom and who ultimately bears its costs.

MyMind - A private, distraction-free AI workspace for saving, organizing, and retrieving thoughts, bookmarks, and inspirations without ads, tracking, or cognitive clutter.

Extracta.ai - An AI-powered data extraction engine that converts unstructured documents into structured data with high accuracy, eliminating manual processing across industries.

i10X - An AI automation platform for the insurance sector that optimizes underwriting, claims, and customer engagement through real-time analytics and intelligent workflows.

Formzil - A one-click platform for creating and distributing forms, documents, and contracts instantly, designed to remove friction from everyday document workflows.

We’re here to help you navigate AI without the hype.

What are we missing? What do you want to see more or less of? Hit reply and let us know. We read every message.

– The OpenTools Team

PS: If you are building with AI heading into 2026, the biggest advantages will not come only from better models. They will come from understanding where constraints, control points, and leverage are forming across the ecosystem. That is where long-term winners are quietly being decided.

How did we like this version? |

Interested in featuring your services with us? Email us at [email protected] |